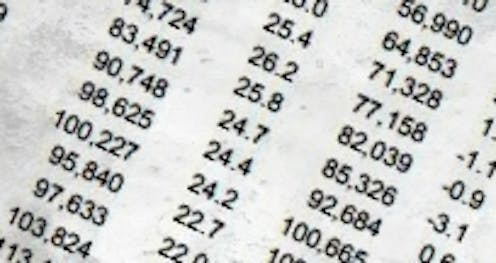

Eye-wateringly bad, yet rosy: why these budget numbers will get worse

- Written by Warren Hogan, Industry Professor, University of Technology Sydney

Thursday’s economic statement is the government’s first attempt to quantify the impact of the coronavirus pandemic on government finances and should be treated with caution.

The near A$300 billion hit to government finances over two years is, as the treasurer says “eye-watering”, but that forecast is as good as it’s...

Read more: Eye-wateringly bad, yet rosy: why these budget numbers will get worse