Budget 2023: Budgeting for difficult times is hard – just ask Chalmers

- Written by Peter Martin, Visiting Fellow, Crawford School of Public Policy, Australian National University

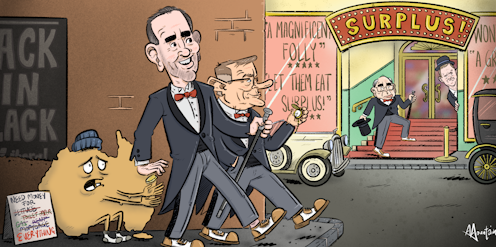

Wes Mountain, CC BY-ND

Wes Mountain, CC BY-NDSurplus or not, the budget papers show us living through pretty awful times.

Living standards measured by the buying power of wages are set to go backwards in 2023-24 as wages are expected to grow by 3.75% while prices rise by 6%.

Separate figures released by the Bureau of Statistics as Treasurer Jim Chalmers was preparing to...

Read more: Budget 2023: Budgeting for difficult times is hard – just ask Chalmers