Buckle up. 2019-20 survey finds the economy weak and heading down, and that's ahead of surprises

- Written by Peter Martin, Visiting Fellow, Crawford School of Public Policy, Australian National University

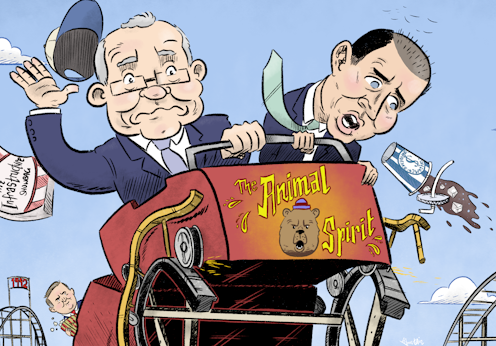

As uncertain as 2019-20 is, The Conversation's team of 20 leading economists are in broad agreement that the outlook isn't good. Scott Morrison and Treasurer Josh Frydenberg will also have to deal with the unexpected.Wes Mountain/The Conversation, CC BY-ND

As uncertain as 2019-20 is, The Conversation's team of 20 leading economists are in broad agreement that the outlook isn't good. Scott Morrison and Treasurer Josh Frydenberg will also have to deal with the unexpected.Wes Mountain/The Conversation, CC BY-NDDuring the election we were promised jobs and growth. But in 2019-20 The Conversation’s...