Postcode by postcode: a clever way to include homes in the age pension assets test

- Written by Anthony Asher, Associate Professor, UNSW

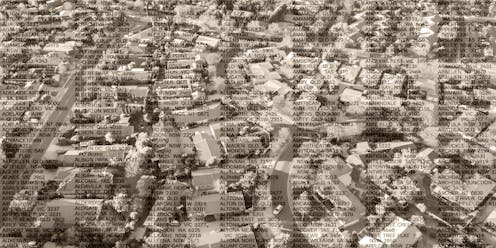

Under the Institute of Actuaries proposal, only retirees with more valuable than normal homes would face an assets test, and only on that part of the value that was higher than normal.Shutterstock

Under the Institute of Actuaries proposal, only retirees with more valuable than normal homes would face an assets test, and only on that part of the value that was higher than normal.ShutterstockHere’s the boldest idea the government’s inquiry into retirement incomes should consider but might not: no longer exempting all of the value...

Read more: Postcode by postcode: a clever way to include homes in the age pension assets test