It'd be a mistake to shut financial markets: more than ever, we need them to work

- Written by Stephen Kirchner, Program Director, Trade and Investment, United States Studies Centre, University of Sydney

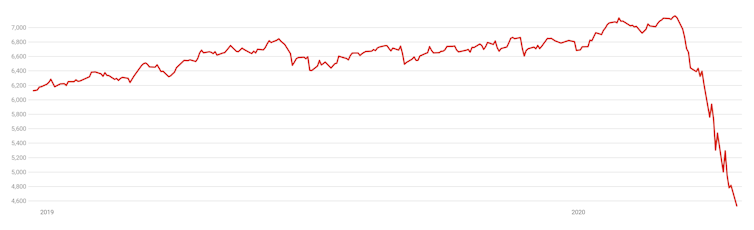

The extreme volatility and losses seen in stock markets in recent weeks has seen calls for financial markets to be closed and short selling restricted.

But shutting them down would be a mistake.

Amid the volatility, financial market prices convey much needed information.

S&P/ASX 200 share index over the past year

Source: Yahoo Finance

Source: Yahoo FinanceIn an early...

Read more: It'd be a mistake to shut financial markets: more than ever, we need them to work