Australia's top economists oppose the next increases in compulsory super: new poll

- Written by Peter Martin, Visiting Fellow, Crawford School of Public Policy, Australian National University

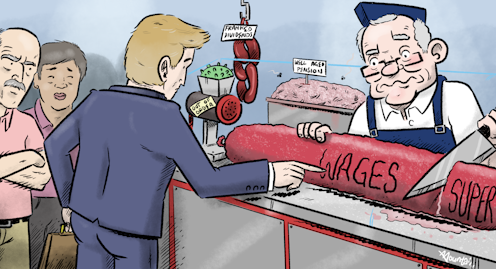

Wes Mountain/The Conversation, CC BY-ND

Wes Mountain/The Conversation, CC BY-NDThe five consecutive consecutive hikes in compulsory super contributions due to start next July should be deferred or abandoned in the view of the overwhelming majority of the leading Australian economists surveyed by the Economic Society of Australia and The Conversation.

Two thirds – 29 of the 44...

Read more: Australia's top economists oppose the next increases in compulsory super: new poll