How will the coronavirus recession compare with the worst in Australia's history?

- Written by John Hawkins, Assistant Professor, School of Politics, Economics and Society, University of Canberra

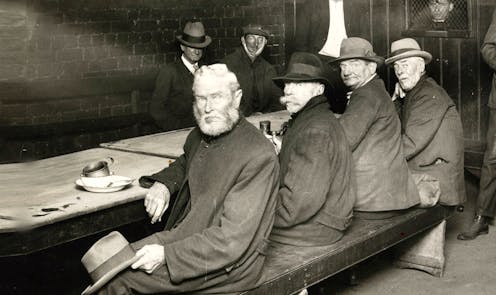

State Library Victoria

State Library VictoriaIn a normal year we would be weeks away from the May budget and the official forecasts for the financial year ahead.

This year there will be no official forecasts until October 6, the date of the postponed budget.

It might be just as well.

The finance minister Mathias Cormann says it is nigh impossible to make realistic and...

Read more: How will the coronavirus recession compare with the worst in Australia's history?