It's hard to tell why China is targeting Australian wine. There are two possibilities

- Written by Markus Wagner, Associate Professor of Law, University of Wollongong

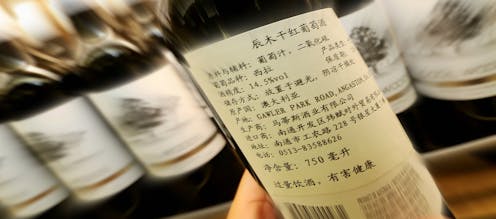

Author supplied

Author suppliedIt’s on again. This time it’s Australia’s wine industry that’s under investigation in China for allegedly violating anti-dumping rules.

The investigation has sent shock waves through the wine industry and beyond.

Broadly speaking, anti-dumping rules prohibit producers from selling anything for less than its...

Read more: It's hard to tell why China is targeting Australian wine. There are two possibilities